If your like most, you've attempted to hit a goal in life, maybe it was a weight loss plan but you were terrified of the scale. Maybe Marie Kondo inspired you to reorganize your house (Thanks, Netflix). Even with all of Marie’s greatness, just the thought of going through the clothes hanging in your closet since 2008 became overwhelming and you landed right back on the bed.. or was that just me? Either way, starting a budget can feel the same.

Seeing the truth laid bare means you can't hide from it anymore. That can be a scary thing for most of us but it’s beneficial in the long run and will put you on the path to achieving good financial health. The truth is, we have to know where we are to know where we need to go. It is similar to a bus route, you've got your driver and they figure out the best route, stop to pick up the passengers along the way, meet the time targets and get you where you need to go. You’re the driver of your financial health! And here's the good news: a goal feels much more attainable when we break it down into smaller steps. Let's start at the beginning.

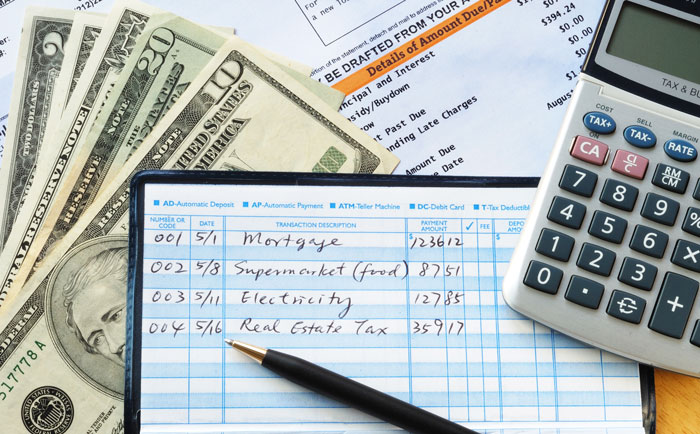

What are your expenses really?

Between work, family, friends & personal relationships it may seem difficult to schedule time aside for yourself but it's the first step to your financial freedom. Schedule an appointment time with yourself to go over how much you typically spend in a month. Start with the non-negotiable items first: housing costs, utility bills, transportation costs, and any monthly debt payments. Once you know what you must spend monthly you can add in things that aren't necessities but do make your life better: monthly subscriptions, gym memberships, entertainment etc. This is when you have a real number for your expenses. Bring your calculations up against your income and answer a simple question: Am I spending more then I'm making? If the answer is yes, it's time to adjust the budget and make new spending choices.

Know your spending priorities

We’ve all had those moments when our friends want to go out on the town and you cringe as you bring up the B word... BUDGET, fearing that your friends may think you’re broke and can’t afford to have fun. There’s such a stigmatized definition of budget and some think it means restrictive or you can't afford anything but that isn't the case at all. If you’re doing it right, budgeting gives you more control. If you know what your priorities are and what you’re wanting to accomplish with your budget then you'll naturally want to spend less on the things that aren't important (ex. restaurants every night=$$$). You will focus on what holds real financial value to you. An expensive night out with the friends may not be in the budget for tonight, but rest assured you'll meet up with them next week for some budgeted fun.

Another example, let’s say you know you want to buy a house of your own and get out of the renting cycle. You realize that saving for the house is a high priority for you and your family. With an accurate budget, you can decide how to best save for the down payment. When the moment comes to dip into your savings for that dream house, you won’t have to worry—because you budgeted it for it.

Your not alone-There's an app for that

Other people are going through the same process as you, seeking financial health & freedom. While the old fashioned pen and paper work great, maybe even spreadsheets on a laptop, if you've got a smartphone though, your budget tool is already there, waiting to be selected from your app store. Everyone's needs are different when it comes to spending and saving, so don't think you have to follow someone else’s plan. We at Advantage Home Plus like a little human guidance that is individualized to meet the needs and goals of each person. That’s why we provide no-cost consultations that help employees understand where they are today with their qualifications and what they should be focusing on to get themselves in the best financial position possible, making a home of their own attainable. Plus, they can download our new app! You can find all the blog news on the app along with nifty mortgage calculators, and other helpful tools.

Wanting to get your spouse involved but don't know how? Make some popcorn, maybe a glass of wine, and break out the chocolate. Don't forget to set the mood by getting cozy and warm, maybe a few candles. Turning your budget night into a date night is easier than you might think! Dream together. Set goals you’re excited about. Talk about your future plans! Turning budgeting into a date night also helps you to remember how much you love the person sitting next to you! It centers the whole process around love. Your spouse’s viewpoint should be considered just as important as your own.

Treat Yo' Self

If you’re still having trouble enjoying the budgeting process, consider giving yourself a reward to enjoy later. The reward doesn’t need to be elaborate. You can choose something simple, like a new book or a delicious cappuccino. The reward can be a lavish budgeted expense like that cruise to Alaska you've been wanting or taking the family to Disney World. Whatever it is, pick a treat you’ll look forward to! I hope that some of these ideas have been helpful to you. Each of them could easily be their own separate post! There are so many ways to make budgeting fun, and anything that makes it more enjoyable is a win in my book!

-jpg.jpeg?width=202&name=2021%20Logo%20AHP-2A%20Color%20(002)-jpg.jpeg)