If you're thinking about buying a home but unsure whether you could qualify for a mortgage or have enough cash for a down payment, you might be worrying too much. Yes, credit standards are higher now than they were a decade ago. But they actually are about the same as in the mid-1990s. Factor in today's low interest rates and current home prices, and affordable mortgages are within reach for many qualified borrowers who may have been hesitant to enter the market.

What Lenders Look For:

It's important to remember that Freddie Mac, Fannie Mae, FHA and VA don’t make loans directly to borrowers; they buy the mortgages from lenders that meet their requirements. The lenders need to follow the guidelines of the specific loan program as set by Fannie, Freddie, FHA and VA.

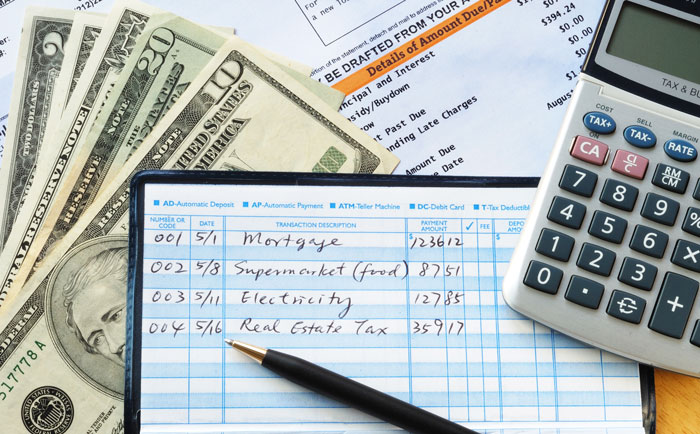

When deciding whether to make you a loan and which type of loan program you qualify for, lenders evaluate the five Cs:

Credit - Your record of paying bills and other debts on time. Believe it or not, It ALL starts with the credit. You can make a million dollars a year, & if your credit is not up to par, you are dead in the water. BUT, your credit does not need to be perfect! In fact, FHA will approve loans with credit scores as low as 600.

Collateral - The value of the home that you plan to buy.

Capacity - Your current and future ability to pay back the loan. Lenders look at your income, employment history, savings, and monthly debt payments, such as credit card charges and other financial obligations, to make sure that you have the means to take on a mortgage comfortably.

Capital - The money and savings that you have on hand plus investments, properties, and other assets that could be sold fairly quickly for cash. Having these reserves proves that you can manage your money and have funds, in addition to your income, to help pay the debt.

Cash to close - Another important consideration is the down payment - the percentage of the cost of the home that you put down in cash when you buy it. Although references often are made to a 20 percent down payment, mortgages can be had with less. Freddie Mac has long allowed for 5 percent down, and FHA programs are available to qualified borrowers with as little as 3.5 percent down. VA loans requires ZERO down payment. There are also various down payment assistances and down payment grant programs available in many markets. If you put down less than 20 percent, however, your interest rate might be a little higher and you could end up paying mortgage insurance.

Closing Thoughts:

Getting a Home Loan does not have to be complicated, but everyone should understand the basics. Our best advice is to align yourself with your non-commissioned employee homeownership advisor. They will help you plan, answer the questions you didn’t even know you had, plus help you save money when you use your benefits.

-jpg.jpeg?width=202&name=2021%20Logo%20AHP-2A%20Color%20(002)-jpg.jpeg)